Electricity Market in South Australia

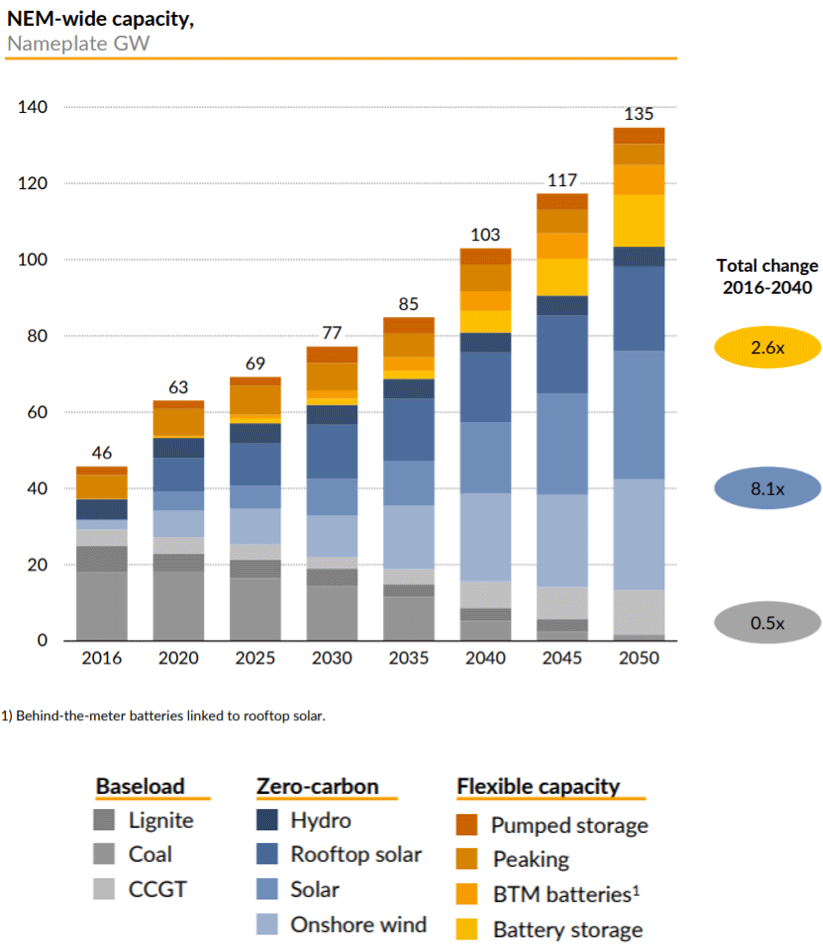

Australia’s energy system is forecast to be dominated by zero carbon generation. Intraday energy price volatility will increase as baseload thermal coal closes down and as the grid relies increasingly on variable renewable energy. As intraday energy arbitrage opportunity increases, medium term (four hour) storage such as the vanadium battery will be in demand.

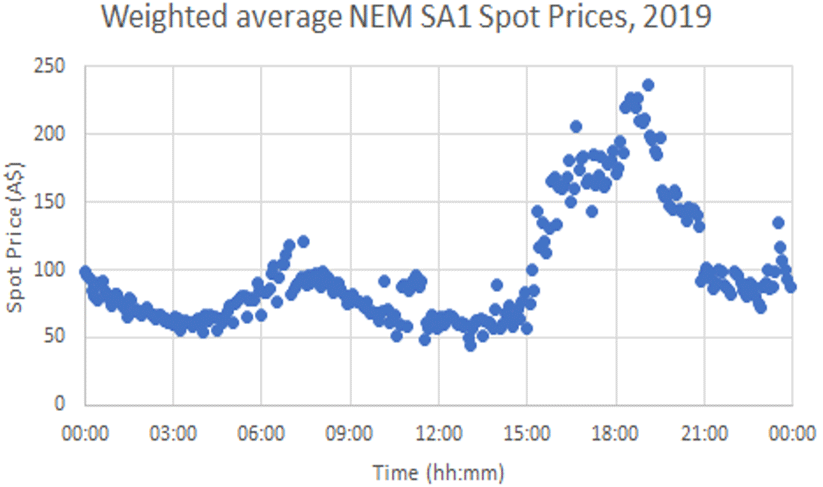

South Australia currently has high intraday price variations. Electricity prices are low at midday, when the sun shines, but much higher at the peak demand periods before the sun rises and after the sun sets. If wind turbine production is low, price peaks can even be higher.

This makes South Australia an attractive market for medium duration vanadium batteries that can arbitrage price differentials each day providing electricity and grid stabilisation services.

Intraday price differentials are expected to exacerbate further as coal fired power stations around Australia are decommissioned over the next 30 years.

Australia forecast capacity mix, Aurora Energy Research, Australia NEM (National Energy Market) Power Forecast, August 2019

South Australia’s Solar Duck Curve

South Australia’s solar “duck curve” is expected to deepen significantly over the next 20 years as base load coal fired thermal generation capacity retires and is not replaced. As more solar generation comes on line, middle of the day electricity prices fall and base load generators are squeezed out because of their high capital costs. Peak prices in the morning and in the evening increase further becoming highly dependent on wind generation. This creates the characteristic duck-shaped curve which creates time shift generation opportunities for batteries and other storage technologies.